Our inboxes are full, our guard is down and AI has changed the game. These are the scams happening in SA right now – and how to avoid them.

Summer is supposed to be the season to relax – but it’s also when your guard is down, your inbox is overflowing, and scammers are on the prowl. That means it’s peak time for fraud: people are tired, spending more time online, indulging in a few cocktails, and not always thinking twice before clicking, buying or replying.

And if you think you’re too savvy to fall for a scam, SA’s cybercops want you to think again.

“Scams are a big issue globally,” says Sergeant David Mitchell from SAPOL’s Financial and Cybercrime Investigation Branch. “Everything’s online now, so that’s giving scammers opportunities … they’re evolving.”

Whether it’s a fake refund, a flirty DM or a job offer that’s too good to be true, here are the scams catching people out this summer – and how to avoid them.

The scams flooding SA this summer

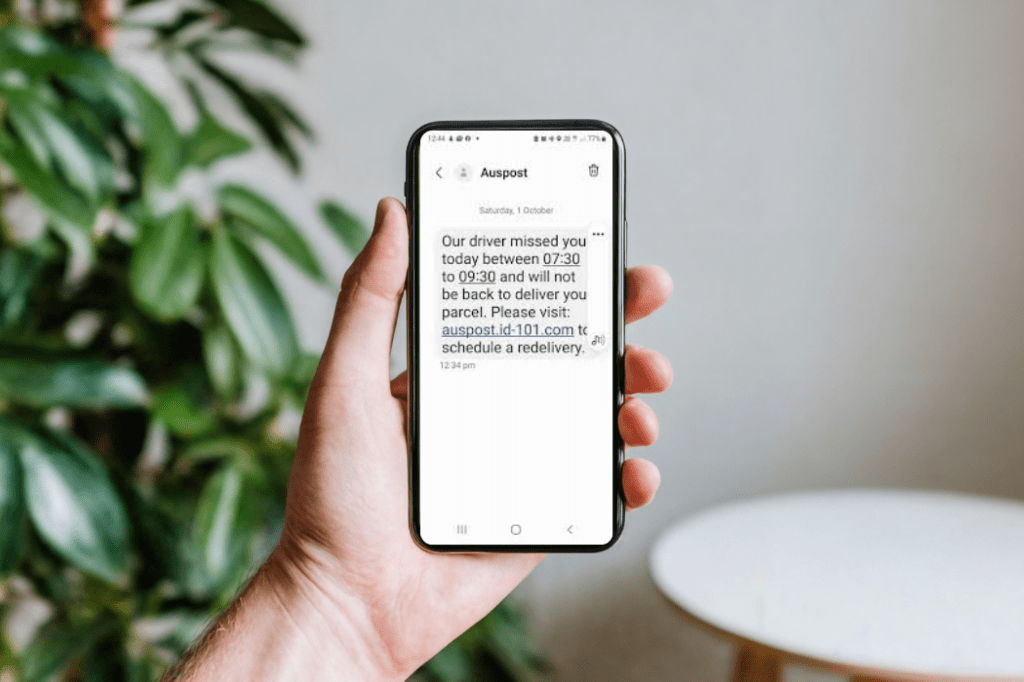

1. Missed delivery and refund scams

After all that Christmas shopping and the Boxing Day sales, scammers are doubling down on fake parcel texts and refund messages. The most common version tells you a delivery failed and includes a link to reschedule or verify your details. But clicking through can give scammers access to your personal data or lead to payment requests.

If you’re unsure, always go direct to the post office or retailer website – never through a link in a message.

2. Side-hustle scams and fake job offers

If your bank account’s hurting after the festive season, a message offering quick cash to work from home can sound tempting. These scams often pop up via DM, WhatsApp or even in the comments of a legit-looking LinkedIn post. The roles usually have vague titles like “finance agent” or “remote admin assistant”, and the pitch is always the same: easy work, big pay.

You might get a small payment upfront to make it seem real — but then you’re asked to do things like “test” transfers, move money between accounts, or complete online tasks.

What’s really happening? You could be unknowingly helping criminals launder money.

“They may ask you to send $200 to another bank account,” says Sgt Mitchell, “and then you’ve just got yourself into a really tight situation there, where you’ve actually laundered money.”

3. Rental scams

January and February is prime time for moving house or booking holidays, which means fake rental listings are rampant. A good-looking property at a decent price might turn out to be a scam.

Sgt Mitchell says you should always use reverse image search on the property photos – if they’re fake, they’ll probably pop up in your results. But his golden rule is to always check the property out in person before making any payments.

4. Ghost stores and online shopping traps

Scammers create entire fake stores to sell fake products, often promoted with emotional backstories about “closing down” or local hardship. The sites vanish once they’ve pocketed your money. Some even use AI-generated images or video to look more legit.

To stay safe, Sgt Mitchell says you should never shop through social media ads. Instead, go direct to the website, check for an ABN, and Google the store name plus “scam” before you buy. Or simply visit the physical store.

5. Marketplace impersonators

Scammers are using fake buyer or seller profiles on Facebook Marketplace, Gumtree and other resale sites and apps. Common tactics include:

- Fake payment screenshots

- Courier scams

- Overpayment requests.

These tricks are designed to look legitimate and push you to act fast. Don’t hand over goods until the payment’s actually cleared – not just shown in a screenshot. If a buyer “accidentally” overpays, don’t send anything back. And if you’re buying something big, never pay upfront without seeing it in person.

6. Festival wristband and QR code scams

With more summer events going fully cashless, scammers are taking advantage of how people top up their wristbands or access tickets. One common trick is placing fake QR codes over real ones – like on posters or entry signs – that lead you to a dodgy payment site. Another is sending texts or emails that look like they’re from the festival, asking you to pre-load your wristband or pay a “top-up” fee.

These scams are designed to steal your card details or payment info. The rule for staying safe? If you didn’t start the process yourself by logging in through the festival’s official app or website, don’t click the link.

7. Sextortion and romance scams

Summer flings and holiday hookups aren’t the only things heating up. Sextortion scams – where scammers threaten to release explicit images unless you pay – are evolving, and AI is making them harder to detect.

“You can create a video within seconds which looks really, really professional,” says Sgt Mitchell. “It’s very, very hard to detect whether it is AI or not.”

These scams often start with an unsolicited friend request and some flirty chat. The scammer may send an image and ask for one in return – or superimpose your face onto fake nudes using AI. Then comes the threat: pay up or they’ll share it with your contacts.

For our deep dive into sextortion and what to do if it happens to you, click here.

AI is making scams harder to spot

From realistic deepfake videos to chatbot-written phishing emails, AI is helping scammers polish their attacks. Fake retail sites are now created in minutes, complete with AI-generated product photos and testimonials.

It’s no longer just about spelling mistakes and sketchy logos. The emotional tactics are the same – but the packaging looks slicker than ever.

Why smart people still get caught

Criminals don’t need you to be naive – just distracted. And summer, with its sales, socialising, and FOMO, is the perfect time to exploit that.

“Scammers usually focus on emotions – fear, greed, lust,” says Sgt Mitchell. “Anybody, even the most professional of us, can be scammed. It doesn’t matter about your age.”

How to protect yourself this summer

Red flags to watch for:

- Job offers by text or DM with no interview

- “Missed delivery” or refund texts asking for card details

- Requests to pay by crypto, gift card or wire transfer

- Online listings with stock images or sob stories

- QR codes in public places or unexpected top-up links

Tips that work:

- Use reverse image search for listings

- Look up ABNs for unknown online stores

- Don’t trust links in messages – go direct to the website

- Never share images you wouldn’t want made public

Mindset that helps:

- Sgt Mitchell wants us all to be “politely paranoid”: “I don’t want people to be afraid of going online … but we can all be a little more vigilant.”

What to do if it happens to you

If you’ve been scammed:

- Stop all contact

- Screenshot everything

- Contact your bank

- Report it at ReportCyber or your local police station.

“It’s not your fault … scams can happen to anyone,” says Sgt Mitchell. “There are support agencies available.”

SAPOL has a comprehensive guide to scams and cybercrime here.

If you or someone you know experiences online abuse, you can go to eSafety for help – Australia’s regulator for online safety – or visit the South Australia Police websitefor more information.

If you or someone you know needs support, contact Lifeline Australia on 13 11 14 or at lifeline.org.au.